As countries across the globe commit to decarbonization goals and further enablement of the clean energy transition, demand for renewables and battery-based energy storage solutions is rapidly growing. In the United States, the passage of the Inflation Reduction Act (IRA) is pushing that demand even higher. This article explores the IRA’s potential impact on energy storage, examines the amount of storage planned for development reflected in U.S. Regional Transmission Organization (RTO) and Independent System Operator (ISO) generation queues, and highlights the need for digital management and market solutions to effectively manage this growth of renewables and storage.

What Impact Does the IRA Have on Energy Storage?

Last year, the clean energy industry celebrated what was and continues to be a historical win – the establishment of the IRA passed into law in August 2022. With ambitious plans for the U.S. power sector to reach zero carbon emissions by 2035, the law provides approximately $370 billion in clean energy investments and – for the very first time – an investment tax credit (ITC) for stand-alone storage. Prior to this legislation, the ITC incentive for storage had only been applicable when paired with solar or other renewables. As a result, this economic improvement for large-scale energy storage projects now positions storage as a more attractive long-term investment for developers.

U.S. Generation Queues in ERCOT and Other Regions Are Filled with Storage and Renewables

In 2020, the Energy Storage Association (ESA) predicted that the United States would need to deploy 100 GW of energy storage by 2030 to meet climate goals. Why? The steady increase in renewable generation, like solar and wind, and retirements of conventional resources like coal and older natural gas plants has created a significant need for flexible generation to help manage the intermittency that solar and wind generation brings to the grid. As the electrical supply paradigm continues to shift, it is crucial both from an economic and grid reliability perspective for flexible generation that can shift on a second-by-second basis to allow grid operators the ability to effectively manage grid fluctuations. The need for the flexibility that energy storage can offer is clear and, with the IRA, the financial incentives to support its growth are in place. Now, we are seeing a significant increase in the amount of storage planned for development reflected in U.S. RTO and ISO generation queues.

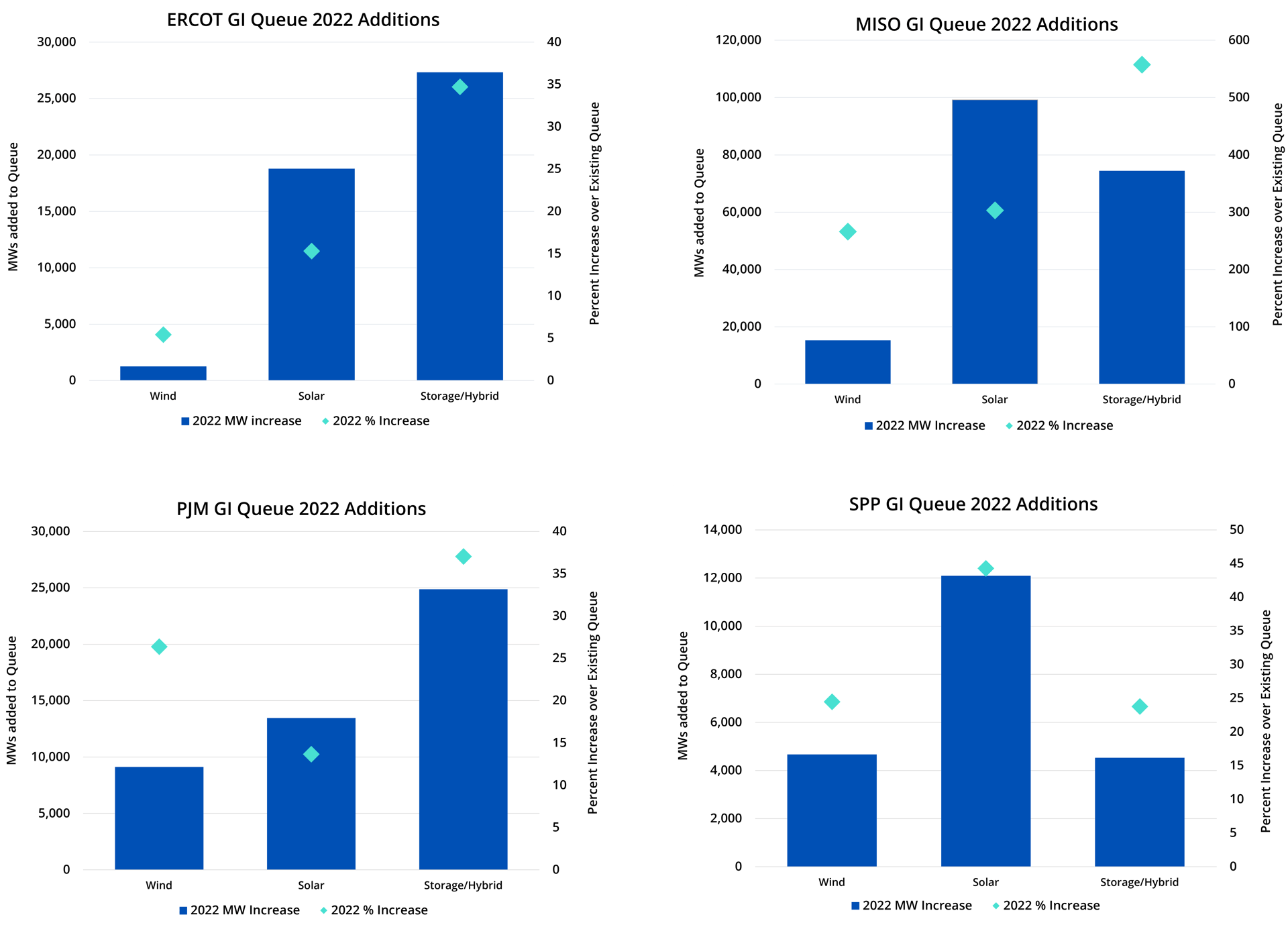

The Electric Reliability Council of Texas (ERCOT), in particular, has seen a lot of this growth. In 2022, ERCOT witnessed a 34% increase in the number of storage projects added to the interconnection queue compared to the queue as of 2021. This was more than double the increase seen for solar and approximately 7 times more than the increase in wind projects. Other regions also experienced similar growth over the same period: the Midcontinent Independent System Operator (MISO) saw a 557% increase in storage, with nearly 75,000 MW added to the interconnection queue and the Pennsylvania, New Jersey, and Maryland interconnection (PJM) saw an increase of 37% for storage projects, outpacing wind and solar additions. Even in the Southwest Power Pool (SPP), where wind development dominates due to the favorable geographic/atmospheric conditions, we see storage beginning to outpace wind in the queue. In these four key markets alone, this translates to over 100 GW of prospective energy storage deployment in the next few years.

While the length of ISO and RTO interconnection queue backlogs could delay the timeline for implementation of these projects, recent reform efforts at the Federal Energy Regulatory Commission (FERC) and the ISO/RTOs may help move queues forward. Even with a conservative estimate for queue entrance to project completion of 20%, there should be more storage deployed in the next 2-3 years than exists on the grid in aggregate today.

Scaling Portfolios of Renewables and Storage Requires Digital Management and Market Solutions

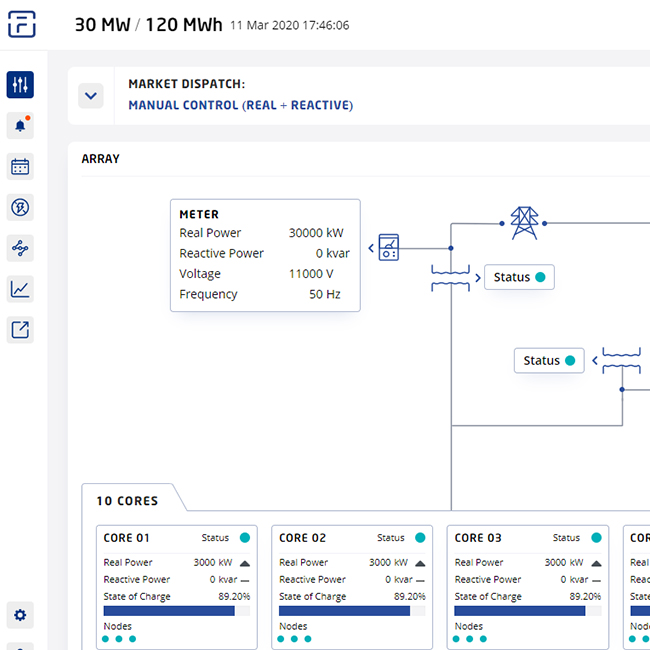

The rapid growth in energy storage and renewables has the potential to accelerate the clean energy transition. However, to fully realize that potential, those assets will have to be managed on a daily basis in a way that fully incorporates the uncertainty and complexity that comes with intermittent renewables and flexible, bi-directional storage assets. Operating assets in such a way is inherently complex. Asset owners, operators, and managers must ensure the asset is available, performing as expected, producing RTO/ISO tariff-compliant bids and offers into the energy market, and providing the needed economic and reliability products the grid requires. It’s becoming more difficult to use manual techniques developed for conventional generation assets to manage diverse, quickly-scaling portfolios of renewables and storage resources. Digital solutions for optimizing operations and facilitating asset management can reduce the workload required to operate and increase profitability from quickly growing and changing asset portfolios, all while ensuring they meet the needs of the grid.

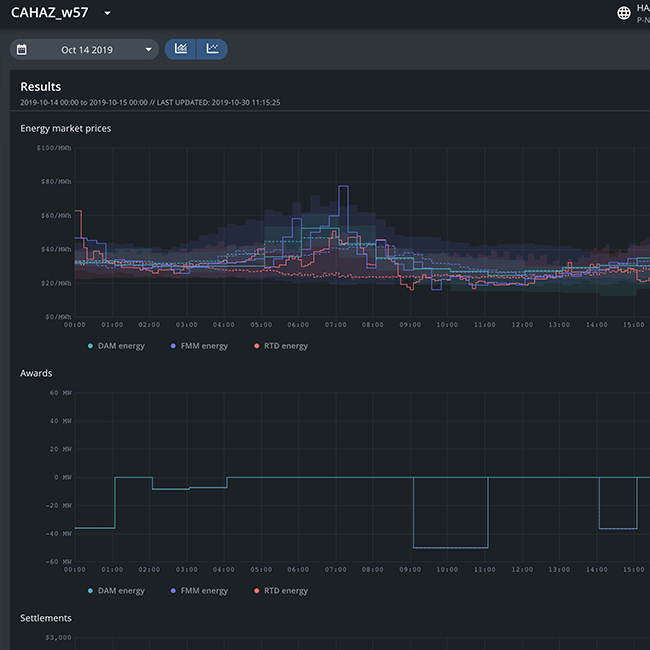

For example, to generate optimal revenue from storage assets in complex, variable markets like ERCOT, energy storage operators would have to ingest thousands of data points on market behavior, prices, weather, load, and more – every hour of every day. Instead, many operators are choosing to utilize software-as-a-service (SaaS) solutions, like Fluence Mosaic™ for ERCOT, to automatically integrate those data streams, leverage AI to forecast prices, and build optimized bids. The result? An estimated 40%-50% increase in market revenue from storage assets compared to manual trading techniques, depending on the node and market conditions.

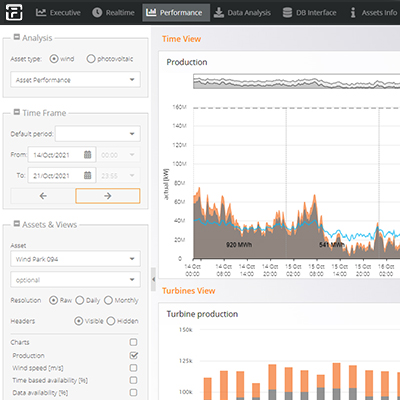

Owners and operators of renewable and storage assets must wrangle with a similar avalanche of data points when trying to identify and act on asset performance issues. The typical wind turbine produces 30,000 data points per minute. For a portfolio of 10 farms and 100 turbines per farm, that can translate to 30 million data points per minute. To manage this data, asset owners often have to scale their teams in lockstep with their portfolio size. Fluence Nispera™, an advanced renewables and storage asset performance management software, automatically integrates performance and financial data across asset sites, classes, and technology providers – and helps users identify issues and prioritize resolution. In turn, our customers often find they can keep the same size asset performance management team, even while rapidly scaling their portfolio.

Digital tools drive value for asset owners and grid operators, making electricity more affordable for consumers, and improving grid reliability and flexibility. Fluence’s commitment to being a lifecycle partner for our customers includes providing innovative digital software like Mosaic and Nispera to enhance the optimization and management of storage and renewable assets. Transforming the way we power the world includes advancing the ways we optimize new technologies for a clean and bright energy future.

What if your energy storage asset bidding were optimized by AI?

Forward-Looking Statements

Any statements that are not historical facts and that express, or involve discussions as to, Fluence’s expectations, beliefs, plans, objectives, assumptions, future events or the performance or safety of new technology and products (often, but not always, indicated through the use of words or phrases such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “intends,” “plans,” “believes” and “projects”) may be forward-looking and may involve estimates and uncertainties which could cause Fluence’s actual results to differ materially from those expressed in the forward-looking statements. Such forward-looking statements are subject to a number of assumptions, risks, and uncertainties, including those described under the heading “Risk Factors” in Fluence’s most recent Annual Report on Form 10-K and in other filings Fluence makes with the SEC. New factors emerge from time to time, and it is not possible for us to predict all such factors. Further, we cannot assess the impact of each such factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Any forward-looking statements speak only as of the date of the post, blog, or other disclosure, and are based on information available to Fluence as of the date of such publication and Fluence does not undertake to update or revise any of the forward-looking statements, whether as a result of new information, future events or otherwise.