Late last year, Fluence announced the acquisition of AMS, one of the world’s leading suppliers of AI-powered algorithmic bidding software for energy storage, wind and solar assets. Since the acquisition, we’ve been working hard to expand AMS' capabilities and continue to provide best-in-class products to new and existing customers. In this post, I’d like to share an update on how the acquisition of AMS is evolving Fluence’s product portfolio, expanding the scope of customers Fluence can serve, and helping Fluence further deliver on its mission of transforming the way we power our world.

Over 1.5 GW of assets under management added in only seven months

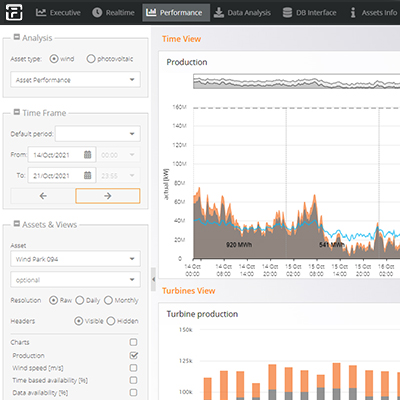

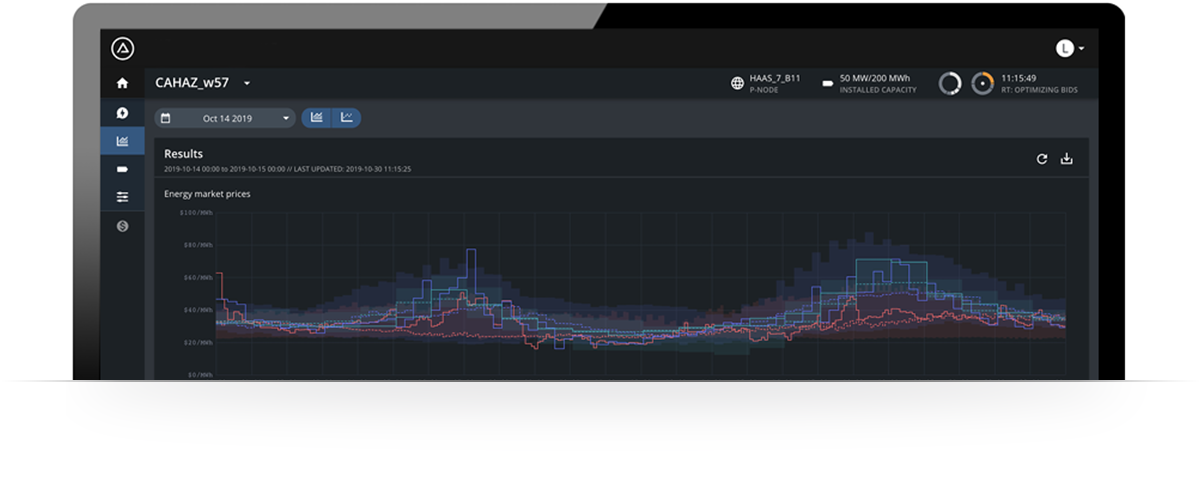

For those unfamiliar with it, the Fluence Trading platform is a leading optimization and bidding software, powered by proprietary AI-enabled price forecasting. The Fluence Trading Platform enables utilities, retailers and power producers to optimize renewable and battery assets from any OEM or technology provider.

Since the AMS team joined Fluence, more developers have chosen our Trading Platform to upgrade their bidding strategy, adding over 1.5 GW of new assets managed by the platform since the acquisition in October:

- In Australia, our NEM Trading Platform is now managing solar and wind assets totalling nearly 2.5GW. That represents roughly 20% of all wind and solar capacity in Australia’s National Electricity Market (NEM).

- In California, our CAISO Trading Platform is managing one of the world’s largest battery-based energy storage projects – and one not supplied by Fluence. Pacific Gas & Electric selected the Fluence CAISO Trading Platform to optimize dispatch of its 182.5 MW/730 MWh Moss Landing battery.

Part of Fluence’s agility as a supplier of energy storage technology has been through the combination of our flexible controls and technology-agnostic approach. Working with an ecosystem of certified suppliers, rather than getting locked into single-supplier relationships, has enabled us to mass-customize solutions to meet customers’ specific needs. The Fluence Trading Platform continues this commitment to agnosticism – by working with any underlying battery storage vendor and a variety of energy technologies, including wind and solar. This provides Fluence with a new way to help customers accelerate the adoption of renewables and energy storage, either separately or together.

Part of Fluence’s agility as a supplier of energy storage technology has been through the combination of our flexible controls and technology-agnostic approach. Working with an ecosystem of certified suppliers, rather than getting locked into single-supplier relationships, has enabled us to mass-customize solutions to meet customers’ specific needs. The Fluence Trading Platform continues this commitment to agnosticism – by working with any underlying battery storage vendor and a variety of energy technologies, including wind and solar. This provides Fluence with a new way to help customers accelerate the adoption of renewables and energy storage, either separately or together.

Fluence: Creating new value with AI-powered software

Fluence’s wholesale market optimization software is helping optimize the transition to a clean, reliable electricity system.

Renewable asset owners are faced with the challenge of increasing negative prices, basis risk, Day-Ahead/Real-Time (DA/RT) spread management, to name a few. Fluence’s software provides leading price forecasting performance and uses proprietary bidding algorithms to automatically manage these risks. The end result is improved financial performance for wind and solar asset owners – increasing revenues by up to 10% over a 12-month period.

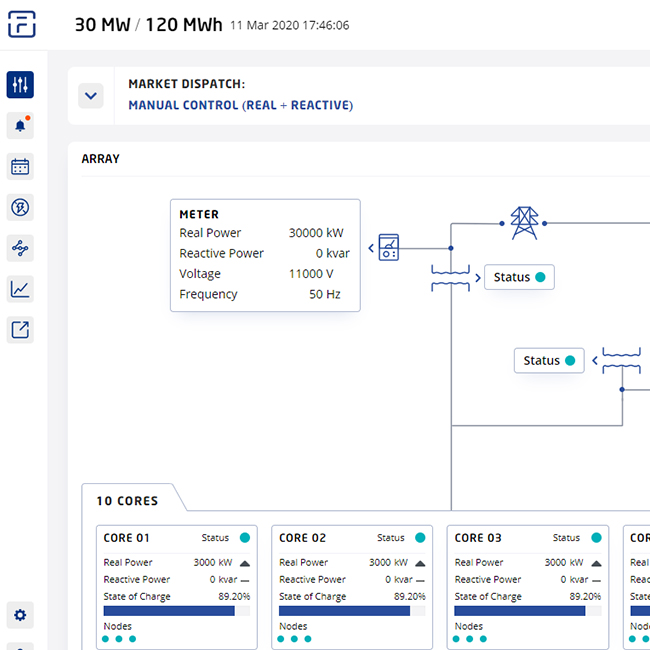

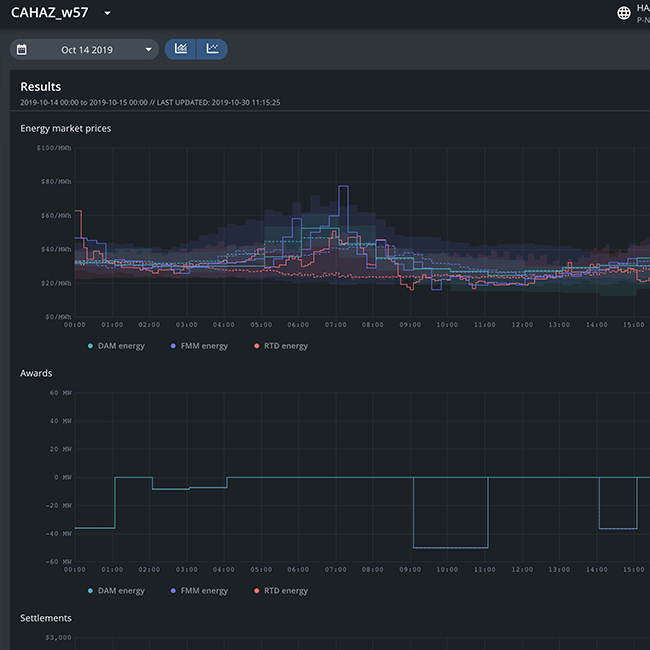

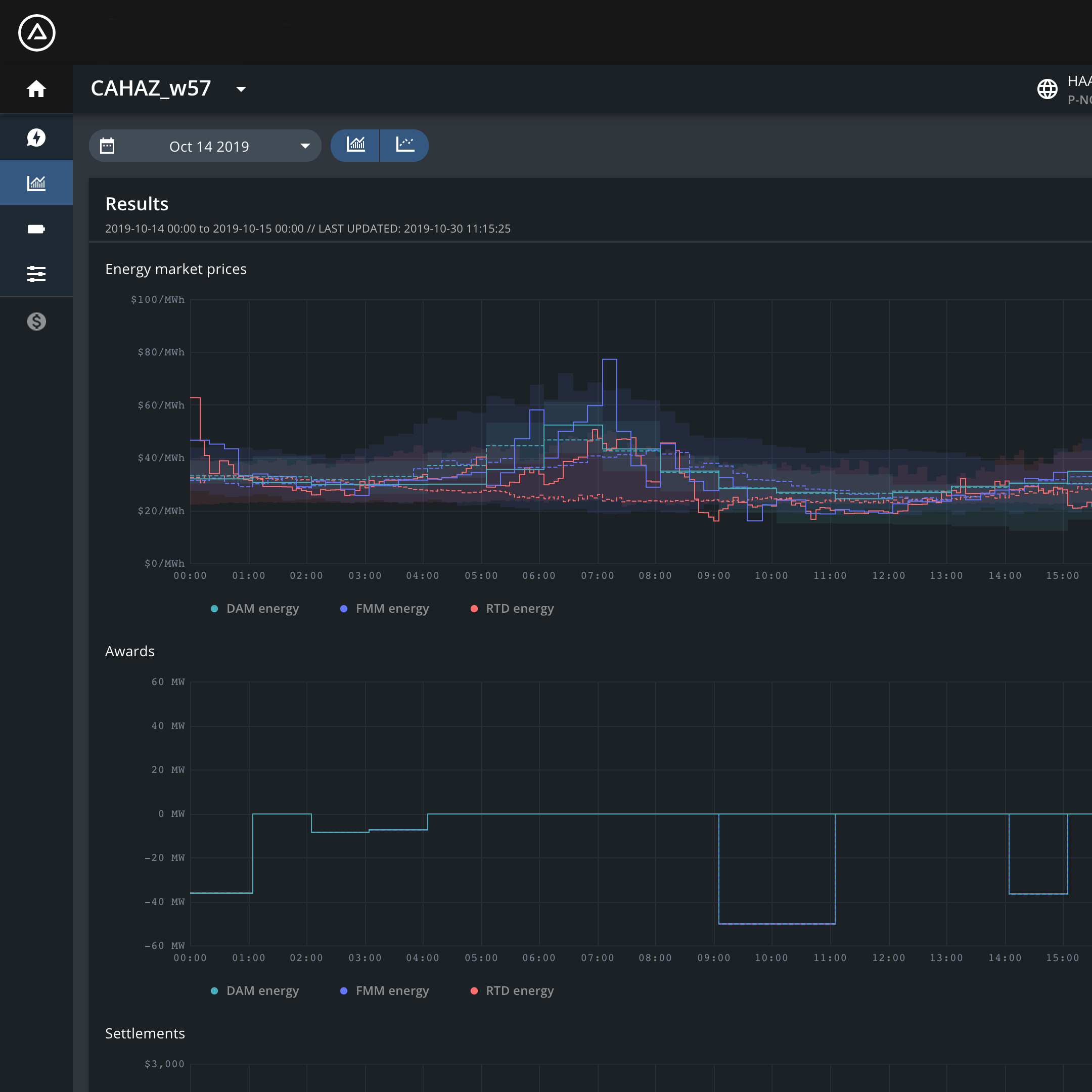

For battery-based assets owners, the challenge is even more complex. Optimization of battery requires a careful balancing act across participation in energy and ancillary services in the face of increasing market volatility. Optimal dispatch of a battery system in a competitive wholesale market requires hundreds of thousands of decisions within the space of a few minutes. Fluence’s bidding software solves this problem by incorporating advanced forecasting, identifying the optimal asset dispatch based on user preferences, and translating that into real-time market operator bids. Crucially, the optimization also respects the physical and financial constraints placed on the asset. In addition, the software provides detailed reporting – of forecasts, market behavior, bids, revenue and asset performance – to inform future bidding.

Sharing lessons from two fast-evolving markets

Just as we’ve done after introducing energy storage to 17 markets for the first time, we believe in sharing lessons we've learned with the market. Over the next few months, we’ll be sharing insights from our work in two power markets on a similar decarbonization journey – California’s CAISO and Australia’s NEM. These markets hold many lessons for other markets embarking on energy transition.

As we offer new services to wind and solar farms, we’re delivering on our mission to transform the way customers power our world. Keep a look out on our blog to learn how software-based algorithmic bidding makes the business case for renewable energy projects stronger in Australia, the role software plays in helping battery projects monetize all available revenue streams, and how to evaluate bidding performance of either type of asset.