- JOINT PRESS RELEASE -

- Diverse suite of financial solutions provide necessary capital to expand growing energy storage sector

- Granting customers access to a combination of proven, bankable energy storage solutions with tailored financing

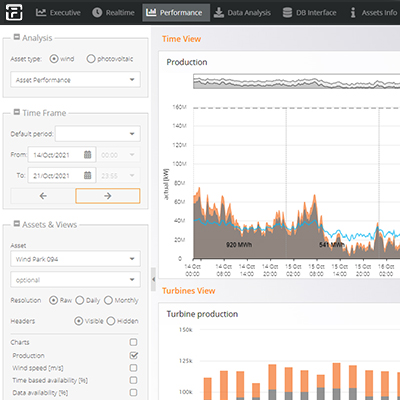

- Leasing and project finance options for qualified projects using Fluence’s industry-leading trio of energy storage platforms

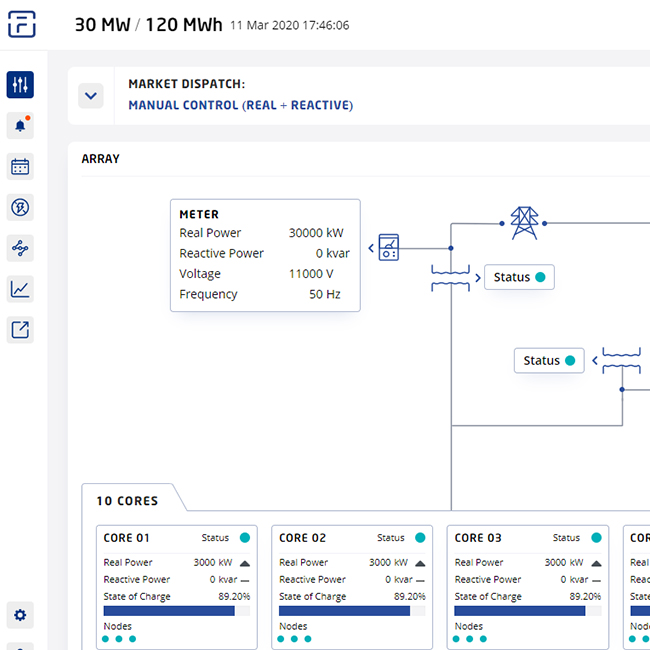

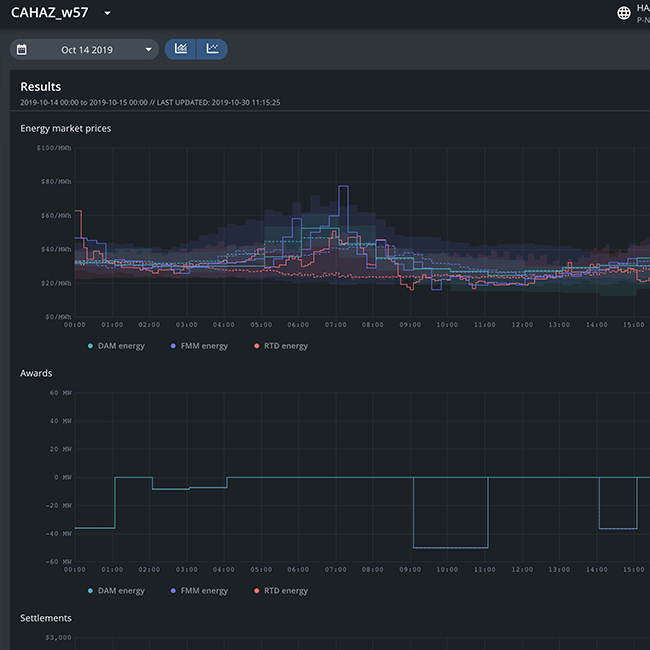

Iselin, NJ January 11, 2018: Siemens Financial Services (SFS) and Fluence, a Siemens and AES company, announce a comprehensive financing program to support customers in their investments in energy storage solutions. The new financing program will offer customers leasing and project finance options for qualified projects using Fluence’s industry-leading trio of energy storage platforms. Fluence’s combination of unmatched energy storage experience, proven technical solutions, and the availability of tailored financial solutions will further drive down the total system costs of energy storage and accelerate the growth of this dynamic segment of the power market, estimated by Bloomberg New Energy Finance (BNEF) to be a $100 billion market opportunity by 2030.

“SFS stands ready to provide significant capital to address the needs of the growing energy storage market through our program with Fluence,” Roland Chalons-Browne, CEO, Siemens Financial Services commented. “Providing customers access to market-leading energy storage technology and the capital needed to realize energy storage projects – regardless of size or region – is unique and will help the market grow exponentially.”

Starting operations this month, Fluence was created to deliver customized energy storage technology solutions and services required by customers and financial institutions. Fluence combines the most comprehensive set of industrial-scale energy storage offerings in the world with the track record, scale, global reach and backing of two large, established power-sector companies. With nearly 500 MW of energy storage projects deployed or contracted in 15 countries, Fluence has nearly twice the track record of any other company.

“With this SFS financing program, we can offer our customers a wide array of capital solutions ranging from small-ticket leases to large-scale project financing and everything in between,” commented Stephen Coughlin, CEO of Fluence. “Financing is often viewed as an obstacle; however by working with SFS, we are simplifying energy storage capital investments for many of our customers, allowing them to move their storage projects forward.”

The financial services arm of engineering giant Siemens, SFS offers suitable financing instruments across the capital spectrum, ranging from leasing and performance contracting to large-scale project finance and corporate finance, in addition to financial structuring and advisory support. With a global footprint, SFS is adept at leveraging its expertise across a variety of markets to serve its customers with tailored solutions.

The financing program with Fluence is unique in that it allows support to a wide array of clients around the world – from commercial & industrial (C&I) energy users to utilities and grid operators – with customized financial solutions to help address their specific project challenges.

“C&I customers typically have smaller-scale projects and are looking for cash-neutral financing options, in which case equipment leasing or performance contracting solutions might work best,” commented Jan Teichmann, vice president of global markets for Fluence. “For utilities and grid operators, their larger, more complex energy storage projects call for project finance in the form of a debt or an equity investment. Working with SFS, we can offer the full spectrum of capital solutions to meet needs as diverse as our customers.”

SFS has gained important experience serving the growing energy storage market in several regions such as:

- United States: Through a project finance solution, SFS provided a portion of the senior debt financing for a term loan to support the construction of AES’s 100 megawatt (MW)/400MWh battery system in Southern California, which is tied to a new, 1,284 MW combined-cycle natural gas generator. The system will replace 1960’s-era power plants in Los Alamitos, Huntington Beach, and Redondo Beach.

- Germany: SFS established a program to provide packaged managed service solutions for municipalities eligible to participate in Germany’s Frequence reserve control market. The program includes projects in the range of five to eight MW peak power that use Siemens’ SIESTORAGE systems.

- United Kingdom: SFS in the United Kingdom recently announced an outcome-based finance model for purchases of Fluence’s Siestorage energy storage systems, which are available to users with on-site electricity demand profiles anywhere between 1MW and 100MW.

Learn more about Fluence and their custom financing solutions with SFS for qualified energy storage projects at http://fluenceenergy.com.

For further information on Siemens’ Financial Services Division, please visit www.siemens.com/finance.

Contact for journalists

Jillian Lukach, Siemens Financial Services

Phone:+1 732 512-7550; Email: jillian.lukach@siemens.com

Steven Goldman, Fluence

Phone: +1 703 721-8673; Email: steven.goldman@fluenceenergy.com