This article originally appeared in RenewEconomy.

In the Australian National Electricity Market (NEM), the energy transition from traditional generation to renewable resources is moving quickly, and new high-tech software tools are making wind and solar projects more competitive in the wholesale market and more attractive to investors. In just the past two years, more than 35% of the NEM’s grid-scale wind and solar farms have started using automated bidding software to optimise their market participation, respond to price signals, and improve financial returns.

No longer content to be passive market participants, many wind and solar farms in the NEM have levelled-up their trading tools and capabilities to become active market participants—and become more profitable in the process, with some renewable assets increasing their annual net revenue by over 10% as a result.

The Renewables Game Has Changed

As the number of grid-scale wind and solar farms has increased in recent years, so have the challenges of operating them profitably in a more dynamic wholesale electricity market. It used to be that completing construction and achieving energisation was the end of a renewable project developer’s worries, but that is no longer the case.

In today’s fast-moving market, managing exposure to negative prices, physical grid constraints, and frequency control ancillary services (FCAS) costs has become a continuous and dynamic challenge for wind and solar farm operators. In an instant, a renewable generator can incur dramatic financial losses (or opportunity costs) by leaving their bid in the wrong place at the wrong time. The days of a ‘set and forget’ bidding strategy are long gone. Now, a growing share of market participants have adopted automated software-based bidding tools—of various degrees of sophistication—to help them participate in the market more actively and respond more dynamically to the NEM’s price signals.

Negative Prices Hitting Record Levels

The wholesale energy settlement price in the NEM can drop as low as -$1,000 / MWh. When energy prices turn negative, the market is signalling an excess of supply from generators, relative to the grid-facing demand for electricity from energy users. During these negative price signals, wholesale payments flow in reverse: generators must pay for any energy they generate to the grid, and energy users get paid for the electricity they draw from the grid.

Evidence of the increasingly dynamic wholesale electricity market can be seen in South Australia, where during the three recent summer months (December 2020 through February 2021) the wholesale energy settlement price was negative more than 20% of the time. Similarly, Victoria has experienced recent months where the price was negative more than 16% of the time, with Queensland experiencing months above 11%. NEM-wide, the month of April saw negative prices nearly 8% of the time.

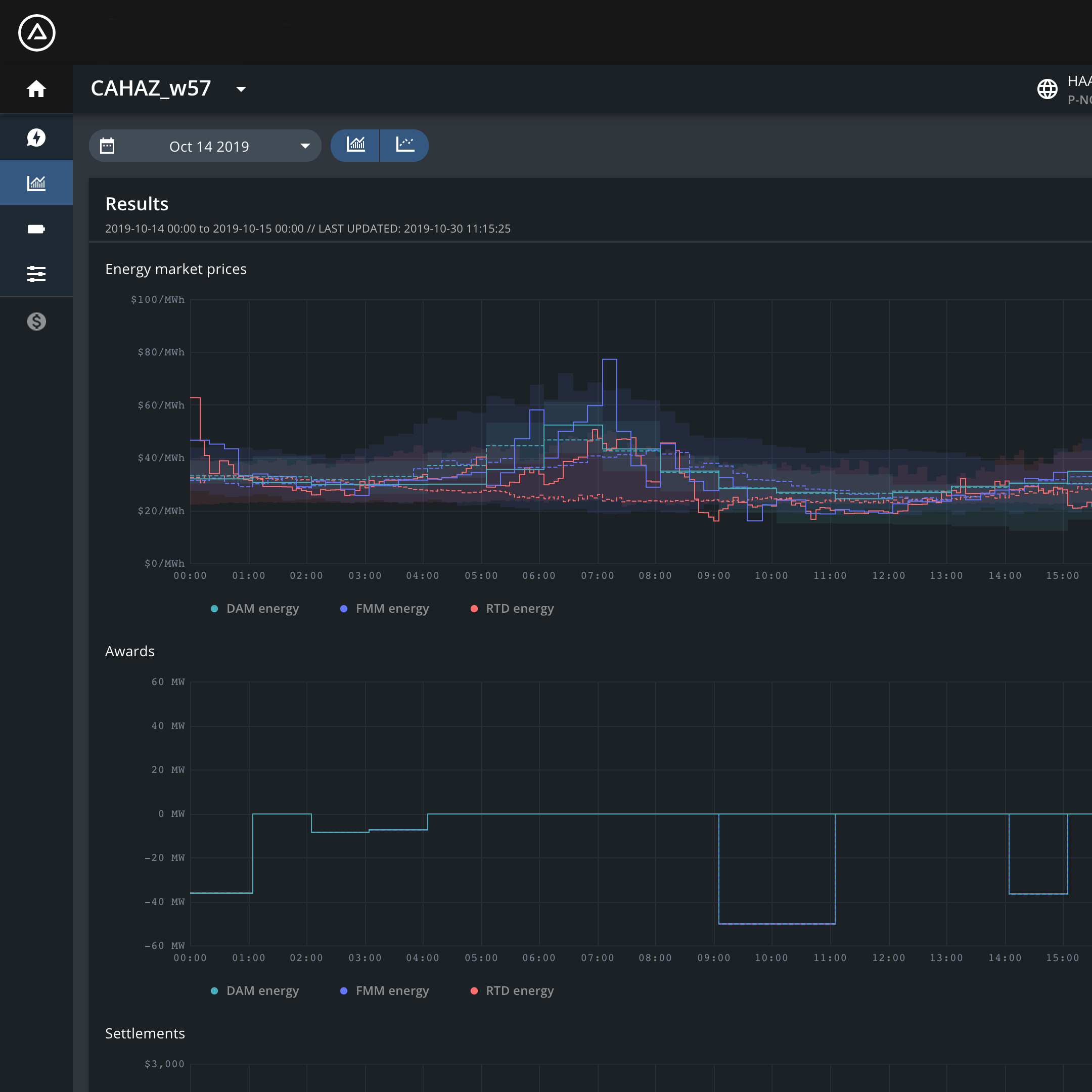

Figure 1: Percentage of time energy settlement prices were negative, by month, since 2016

(all NEM regions combined)

![Figure 1[3][1]](https://blog.fluenceenergy.com/hs-fs/hubfs/Figure%201%5B3%5D%5B1%5D.png?width=1087&name=Figure%201%5B3%5D%5B1%5D.png)

The impact of negative prices is most pronounced on solar farms: if you restrict the count to ‘solar generation hours only’, the percentages in the chart nearly double. A recent report from AEMO noted that across all of Q1 2021 (Jan-Mar) in South Australia, the average spot price during peak solar production hours (10:00 to 15:30) was -$12/MWh. Renewable assets in South Australia need to carefully choose which intervals they bid to generate, and which intervals they would rather sit out.

Depending on their commercial arrangements, negative prices can cause steep financial losses for some wind and solar farm operators (not to mention owners of traditional generators) so amidst this dramatic recent increase in negative prices, it is no surprise that asset owners have looked for solutions to help them minimise financial losses and maximise asset value.

Revenue Headwinds Beyond Negative Pricing

Avoiding negative prices is not the only emerging challenge that wind and solar operators need to manage in the bidding process. Renewable operators must also bid such that they simultaneously minimise having generation output limited due to physical grid constraints, avoid losses due to Contingency Raise FCAS cost allocations, manage discrepancies between the local dispatch price and the regional reference price, and meet any contractual PPA obligations - all the while ensuring that any bid updates they submit are formed on a valid basis and structured in a compliant format.

FCAS cost allocations in particular have become an increasingly large line item on many wind and solar farm settlement statements, as the NEM has experienced record FCAS costs in recent years. For example, in 2020 each wind farm in Tasmania paid Contingency Raise FCAS costs that equated to more than 7% of their wholesale energy revenues. In 2020 in South Australia, most wind and solar farms paid over 10%, and one unlucky solar farm paid over 20%.

Traditionally, wind and solar operators took Contingency Raise FCAS cost allocations as a given – just the ‘cost of doing business’ – but recent steep increases in FCAS costs have caused some operators to turn to automated bidding software to help them actively manage – and minimise – these costs by continuously estimating them and incorporating them into bid prices. In this way, some wind & solar farms are ensuring that all their marginal costs of production are always reflected in their bid price.

Flexible Assets and the Bidding Process

Modern wind and solar farms are highly flexible assets that can fully reduce or restore their output within a single five-minute dispatch – but they are only permitted to do so by first seeking permission from the market operator (in the form of an updated bid) and then receiving an updated dispatch target. In this way, changing renewable output is coordinated through the central dispatch process, so that AEMO can keep the power system in balance. A recent rule change initiated by the Australian Energy Regulator (AER) reinforced this concept and the importance of utilising the bidding process.

New Problems, New Solutions

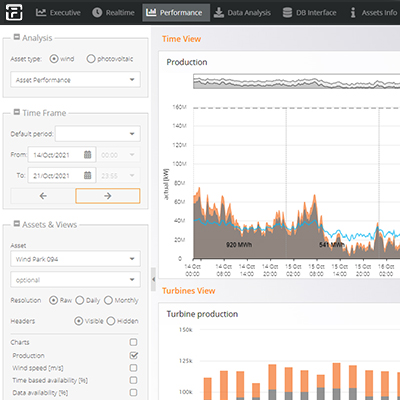

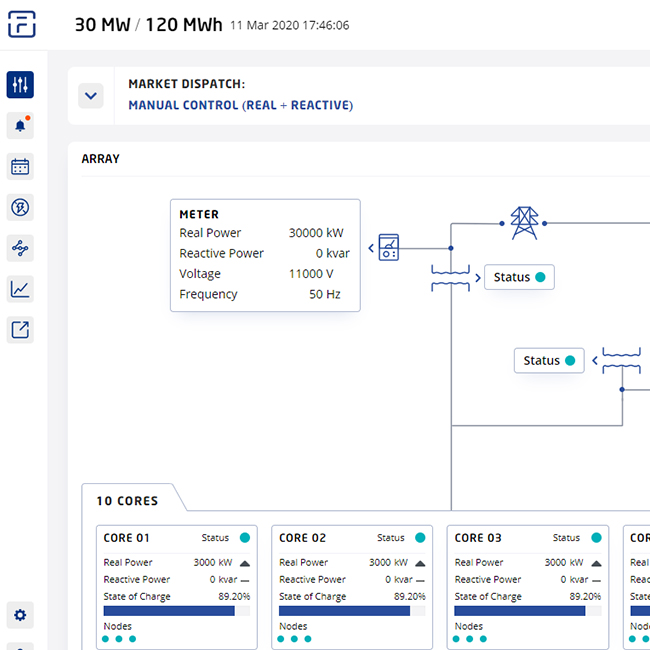

To address these emerging challenges, a new class of automated bidding software tools have emerged, including the Trading Platform we offer at Fluence. The new bidding platforms used by renewables and battery asset operators exhibit a spectrum of sophistication: from simple rules-based auto-bidding logic based on the public price forecast, to complex optimisation algorithms and private price forecasts created with machine learning techniques.

While the sophistication and performance of automated bidding tools varies considerably, market participants are primarily using these tools to achieve a common objective: to help wind and solar assets maximise their net revenue by bidding to maximise generation when wholesale prices are expected to be favourable, and bidding to avoid dispatch at times when wholesale prices are expected to create financial losses.

Rapid Adoption of Automated Bidding Solutions

In its recent Quarterly Energy Dynamics report for Q1 2021, AEMO estimated that around one third of the semi-scheduled renewables capacity in South Australia and Queensland have adopted automated bidding tools. Indeed, we estimate that more than 35% of renewables market-wide have taken up automated bidding, and that all of them have done so in the space of just the past two years. The Fluence Trading Platform alone is being used today by more than 2,500 MW of wind and solar capacity, or about 20% of the semi-scheduled wind and solar capacity in the market. These numbers will continue to climb, as the hundreds of megawatts in our pipeline progresses through the commissioning process.

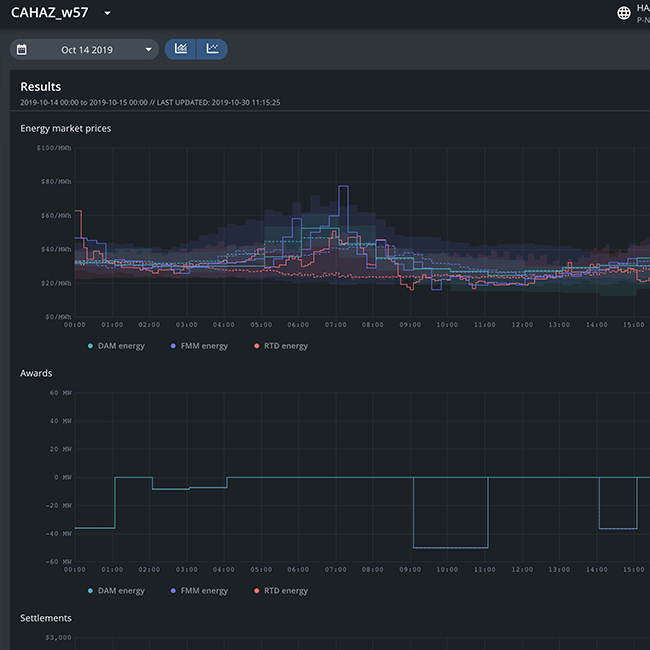

To provide some detail on how one bidding platform works: The Fluence Trading platform uses machine learning techniques to create forward-looking price forecasts for both energy & FCAS. By leveraging machine learning, we have been able to create proprietary, probabilistic price forecasts that have consistently proven more accurate than the only publicly available alternative – AEMO’s Pre-Dispatch price projections.

After creating price forecasts, the platform runs a complex optimisation process that considers the price forecasts, the asset’s physical capabilities, and the owner’s configured commercial preferences and risk tolerances – including the terms of any financial contracts or PPAs – to create and then submit an updated bid file to AEMO. The platform’s optimisation algorithms are able to consider and process thousands of data points every five minutes – ensuring bidding decisions are made robustly and are based on the most up-to-date picture of market conditions.

Dynamic Bidding Is Delivering Six-Figure Annual Increases in Revenue

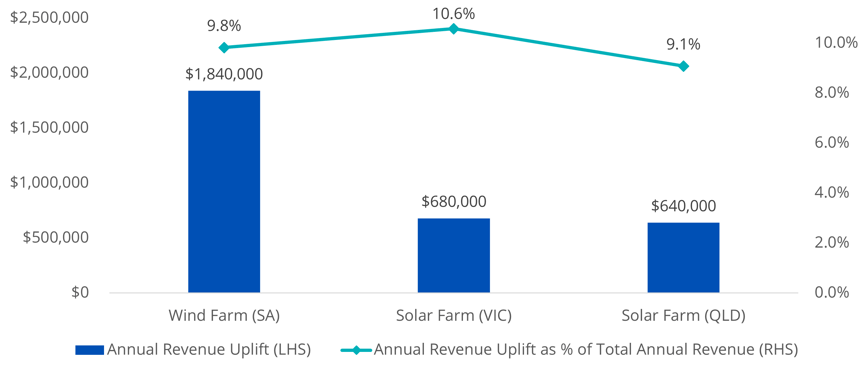

Depending on an asset’s circumstances – including its size, location in the grid, and its commercial arrangements – we have seen that our trading platform can deliver some asset owners double-digit percentage increases (‘uplift’) in annual net revenue.

The chart below summarises the revenue uplift realised by a selection of Fluence’s customers in calendar year 2020. Relative to a legacy static bidding strategy, many asset owners have seen six-figure, 10%+ increases to their annual net revenue as a result of switching to bidding dynamically.

Figure 2: CY 2020 revenue 'uplift' from using automated dynamic bidding vs. a static bidding strategy

From Minimizing Cost to Creating Additional Value

For many years, innovation in the renewable energy and energy storage sectors focused primarily on minimizing cost, with development of larger wind turbines, more efficient PV panels and lower-cost battery cells and modules driving continuous decreases in installed cost.

Now, innovation is starting to focus on creating additional value in the market, with wind and solar farms using high-tech software platforms to respond to market price signals and improve their revenues. Automated bidding systems have already transformed the way some of the NEM’s batteries, wind, and solar farms interact with the wholesale market, and if recent history is a reliable guide, we expect they will play a growing role in the NEM in the years ahead.